by Neil Da Costa | Feb 10, 2022 | Uncategorized

One of the fundamental areas in tax is adjustment of profits. This is because taxable profits is not the same as accounting profits.Typically, you are given the accounting profits and have to find taxable profits. You need to bear in mind that the accountant has...

by Neil Da Costa | Feb 9, 2022 | Uncategorized

An important area in the Advanced Tax exam is Research and Development. This is the only expenditure on which we can claim tax relief of more than 100%.The enhanced allowances are available on revenue expenditure directly relating to the research activities such as...

by Neil Da Costa | Feb 8, 2022 | Uncategorized

Professional ethics questions feature in all the accountancy qualifications, but many students do not pick up all these relatively easy marks.There are 2 main reasons for this.1. Candidates do not understand the scenario and tend to write generic answers instead of...

by Neil Da Costa | Feb 7, 2022 | Uncategorized

Many young people have experienced a sharp drop in self-esteem and wellbeing under the pandemic according to the Prince’s Trust.Here are 8 Simple Techniques To Make You Feel Better1. Build A Strong Support Network -sharing your concerns with a family member or friend...

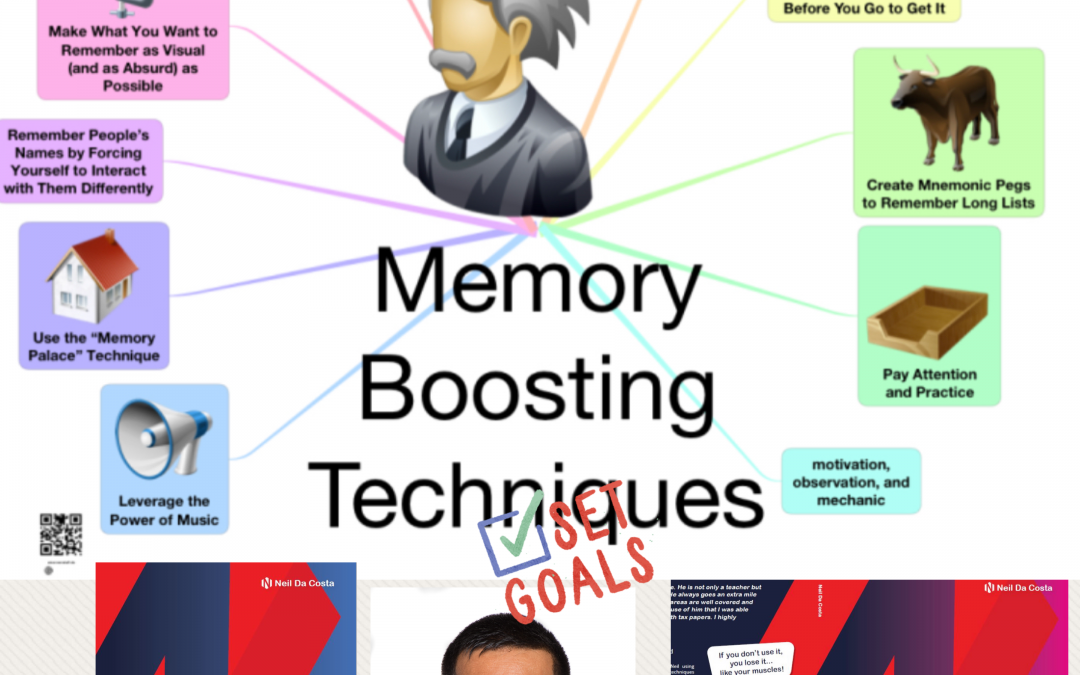

by Neil Da Costa | Feb 7, 2022 | Uncategorized

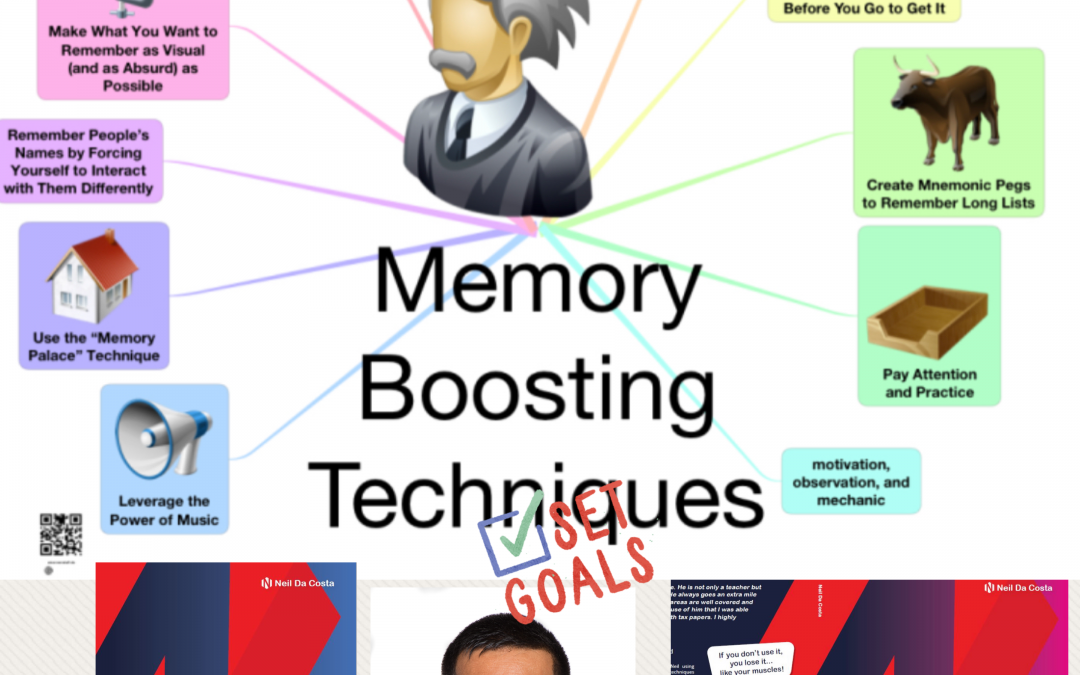

Mind mapping is a useful tool for learning technical information particularly in subjects like tax where you need to learn all the tax rules. Memory works by forming linkages between different concepts and help reinforce these connections creating neural pathways in...

by Neil Da Costa | Feb 6, 2022 | Uncategorized

The rules regarding establishing residence of an individual are one area I expect could feature in the Tax and Advanced Tax exams.It is initially important to work out if the individual is a leaver or arriver to the UK.We then use the automatic non-residency tests....

Recent Comments